Bank Branch Closures Drive Record Broker Demand

If you’ve noticed fewer bank branches in your area, you’re not imagining it. Across the country, physical bank locations are disappearing quickly, leaving many customers searching for more personal, reliable financial support.

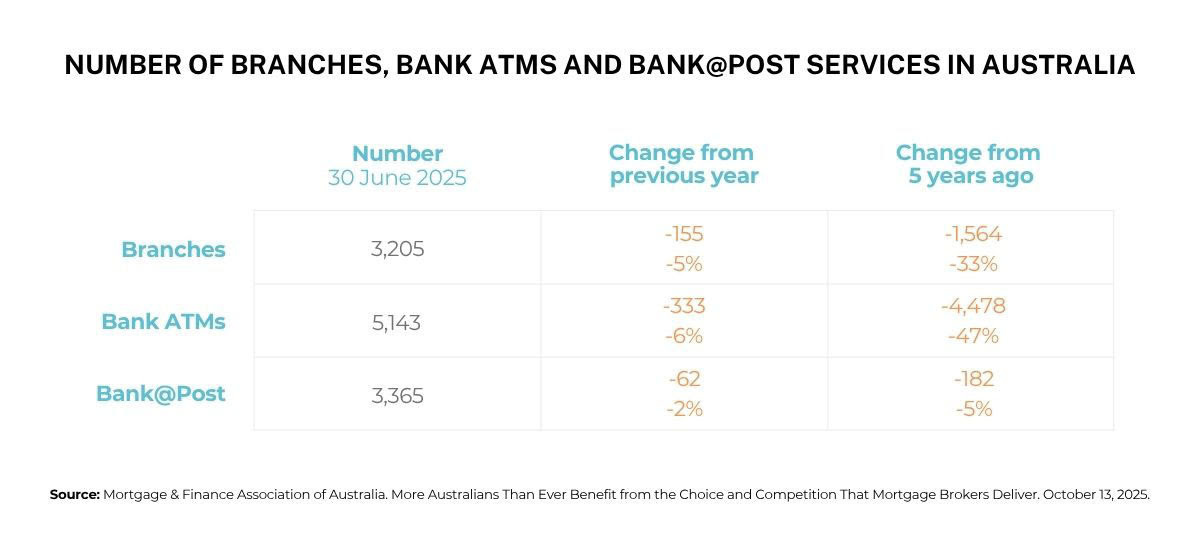

According to Canstar’s analysis of official banking data, the number of bank branches has dropped by 5% in the past year and a massive 33% over the past five years. As banks move online, the personalised service many people relied on has become harder to find. This shift is one of the key reasons more Australians are turning to mortgage brokers for help with their lending needs.

Why Mortgage Brokers Are Filling the Gap

Almost every banking service can now be done digitally from opening accounts to applying for loans. While convenient, this often leaves borrowers without guidance or a human touch. Mortgage brokers in Australia bridge that gap by offering tailored, one-on-one advice that banks no longer provide in person.

More Australians are turning to mortgage brokers because they can compare dozens of lenders, explain complex loan structures, and manage the process from start to finish. Whether it’s your first home, an investment property or a refinance, a broker works for you, not the bank.

Brokers Now Handle Record Home Loan Volumes

This growing reliance on brokers is reshaping the lending industry. According to Cotality research, brokers now write a record 77.6% of all new home loans, up from 67.2% just two years ago, which is a clear sign of growing trust and preference among borrowers.

A major reason more Australians are turning to mortgage brokers is the Best Interests Duty, which legally requires brokers to act in your best interests. This gives borrowers peace of mind, knowing the advice they receive is designed to benefit them, not a lender’s sales targets.

Personalised Help in a Digital World

As the traditional branch network continues to shrink, the demand for mortgage brokers in Australia keeps rising. Borrowers value the expert guidance, wider lender choice, and personal touch brokers offer. Whether you prefer to meet face-to-face or online, a broker can simplify the process, handle paperwork, and negotiate the best deal on your behalf.

If you’re thinking about buying a property or refinancing an existing loan, now is the perfect time to explore your options.